Scammer E-mail and Fraudulent Checks

Have you ever received a “Legal Inquiry” email from an individual with a non-typical name? If so, you should take a few moments and conduct some due diligence—there is a chance you are walking into a fraudulent scam that will cost you and your firm money.

These fraudulent e-mails have a few common red flags including:

A general inquiry (“Dear Attorney” or “Dear Counsel”);

A very broad scope of service that almost always relates to transactions (“Purchase agreements and transactions” or “the sale of equipment” or the “settlement of a dispute that is near settlement”); and or

Janky language (“I will like to inquire”).

If you read an e-mail with these signs, and you still decide to contact them, you should be aware of the following:

They will respond to e-mails, but never the telephone;

They will ask if the money can be deposited into your IOLTA account; and or

They will send you money before you send them a fee

If the individual does send you money or requests that you deposit funds into your escrow account, you should consult the Rules of Professional Conduct (“RPC”). When dealing with client funds, checks, or any advance fee you should specifically look at RPCs 1.5, 1.15(A), and 1.15(B), which require advance fees to be deposited in a trust account and that fee agreements be communicated, preferably in writing, before or within a reasonable time after commencing the representation.

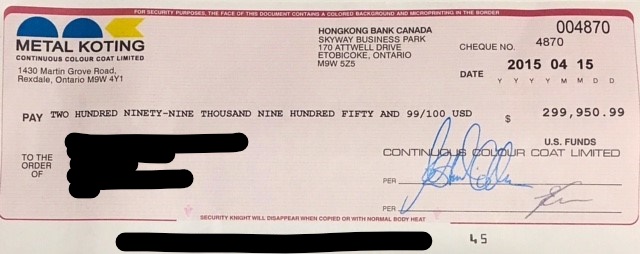

If you do receive the funds, you will notice that it is a large amount ($100,000.00 to $1 Million). We recommend running through some additional due diligence that is listed below with any check you receive from a new client. Under the scam, if you decide to deposit the check, the contact will generally ask that you transfer the funds to another person or transfer the funds back. Typically, the new client will urgently and frequently check with you to confirm you are making the transfer or sending funds.

The perpetrator is trying to get you to assume the funds are actually available in your account just because your online banking system says they are. The check could still bounce, be cancelled, etc. One should treat the check like any other large deposit, call your bank and confirm that the funds have cleared your IOLTA account before you take any further action. If you do pay the funds, and the bank does not clear the check, you may be liable for those funds.

You should always complete your due diligence before you deposit a check from a new client. The costs of not takings some basic safety measures can be very costly. Another step we recommend is calling the issuer of the check and sending them a PDF of the check to request confirmation it is legitimate. We have seen checks that are very real looking, one of which is included at the bottom of this article. One check we received contained a real bank account number and routing number. Given other red flags, we checked with the issuing bank. They confirmed that although much of the information on the check was accurate, the check was fraudulently issued. Do not underestimate the lengths people will go to defraud you by pretending to be a legitimate client.

This scam is nothing new and it is not going away. In fact, the American Bar Association’s law practice magazine published an article on this issue in August 2010 entitled “Preventing Check Fraud: Why ‘The Check is In the Mail’ Isn’t Always a Good Thing.” Also, the NW Sidebar division of the Washington State Bar Association also wrote about this in an article last year called Beware of Bad Check Scams Aimed at Lawyers.

If you are contacted by a scammer or receive a fraudulent check, please report it to the authorities. You can file a complaint online with the Federal Bureau of Investigations Internet Crime Complaint Center (IC3).

Example of a Bad Check:

*This article is intended to inform the reader of general legal principles applicable to the subject area. It is not intended to provide legal advice regarding specific problems or circumstances readers should consult with competent counsel with regard to specific situations.*